Strategic Selling and Profit-Taking Framework

Mastering the Art of Exits: A Proven System for Maximizing Profits and Managing Risk

There is no “One-Size-Fits-All”-Strategy for Selling

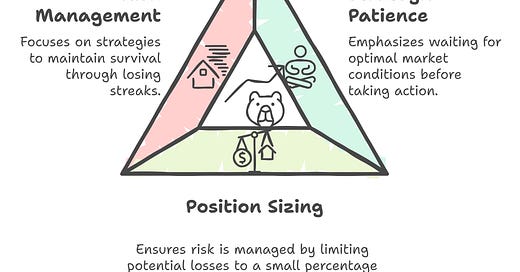

The choice of the right trading strategy depends heavily on your individual trading style, risk tolerance, and market objectives. Rule-based approaches and chart-based signals can be highly effective, but their success relies on how well they align with your personal preferences, strengths, and psychological resilience.

For example, traders with a disciplined, systematic mindset may thrive with rule-based systems that emphasize strict stop-loss levels, staggered profit-taking, and dynamic position adjustments. On the other hand, traders who excel at reading market behavior may prefer using technical chart signals like distribution days, exhaustion gaps, or deviations from moving averages to time their exits.

The key is to understand your own tendencies as a trader and to adapt these strategies to complement your goals and decision-making process. Customization is essential because what works for one trader might not fit another, particularly when managing emotions and navigating market volatility.

Importance of selling into strength to maximize profits

William O'Neil and other renowned traders such as Mark Minervini and Jeff Sun emphasize the importance of selling into strength to maximize profits, minimize risks and maintain emotional discipline. This means taking profits while stocks are still climbing, rather than waiting for an elusive peak.

O'Neil's Chart-Based Sell Signals

William O'Neil recommends selling based on key chart signals, including:

The largest daily gain in a stock's price.

Surging volume that marks potential exhaustion.

Exhaustion gaps or climactic tops.

Signs of distribution (institutional selling).

Events like stock splits, multiple down days, or breaks below the upper channel line.

Sharp deviations from the 200-day moving average (200-MA).

These signals are designed to help traders exit trades before a reversal erases hard-earned profits.

Advanced Selling Strategies and Profit-Taking Framework for Swing Traders by Jeff Sun

This profit-taking and stop-management system is inspired by a renowned swing trader @jfsrevg on X (Twitter). It’s designed to maximize profits, minimize drawdowns, and smooth the equity curve while maintaining disciplined risk management. Here's how it works:

Framework for Managing Trades

1. Entry Day (Day 0): Initial Position Setup

Enter a trade with 3 stop levels, typically spaced at 33% intervals:

Stops protect 33% of your net position size at each level.

Final stop is generally placed at the Low of Day (LoD).

Risk Allocation: Each stop manages an equal fraction of the position size to evenly distribute risk.

2. Profit-Taking Rules (Day 0 to Day 2)

Profit ≥ 2x Risk:

Immediately take off 33% of the position to lock in gains.

Keep all 3 stop levels but adjust them to reflect the reduced position size.

Rationale: This approach balances capturing quick profits with holding onto potential winners. Recognize that realized 1R losses often exceed nominal expectations due to slippage, spreads, borrowing fees, and liquidity issues.

3. Day 3 Adjustments

Partial Profit-Taking:

Reduce the position by 33% if the trade shows limited follow-through but remains above the average entry price.

Tighten Risk: Consolidate all stops to a breakeven level for the remaining position size.

Purpose: This reduces exposure on trades that fail to materialize while keeping the remaining position risk-free.

4. Day 4 and Beyond: Trend-Following Rules

Use a mental trailing stop at the 10-MA (10-day moving average):

Exit only if the stock closes below the 10-MA.

If it does, keep stops at breakeven but adjust to the next day’s opening range low (ORL).

Reassess the stop daily based on price action while allowing the trade to ride as long as it respects the 10-MA.

Special Situations & Nuances

Catalyst and High-Volatility Events

For trades triggered by a catalyst gap or unexpected news:

Immediately take off 33% of the position if the trade delivers 2x profit-to-risk quickly.

If the move extends to 8-10x ATR% above the 50-MA, consolidate all stops to breakeven and consider trimming additional size to lock in gains.

Example: In a catalyst-driven trade, taking early profits on strength helps mitigate potential reversals after explosive moves.

Consolidation and Adding Size

During sideways consolidation below 4x ATR from the 50-MA, consider adding 50% of net size using an inverse pyramid strategy.

This approach keeps your average price below the 10-MA mental stop while allowing you to capitalize on potential trend continuations.

Treat these additions as part of the same trade to avoid overcomplicating risk management.

Rebounding After Stops Trigger

If the price triggers 1 or 2 stops before Day 4 and later rebounds above the prior day's high, consider re-scaling into the trade:

Add 50% of the remaining position size back (e.g., 3,334 shares downscaled to 1,667 shares).

Maintain a conservative approach to ensure total risk never exceeds 1R.

Managing Large Unrealized Profits

If a swing trade trends beyond Day 4 and delivers 7-10x ATR% extensions, consider:

Selling on strength by trimming 33% of net size.

Adjust stops to breakeven for the remaining position, allowing the trade to ride the trend while protecting profits.

You can access Jeff Sun's TradingView indicators through this link:

Tradingview Indicators Jeff Sun

Gap-Down Opens Below the 10-MA

If the trade gaps down below the 10-MA, follow the ORL routine:

Set a stop at the opening range low for the day and allow the market to dictate the trade's continuation.

Psychological and Practical Insights

Reducing Drawdowns:

This system minimizes monthly drawdowns by locking in partial profits early and consolidating risk at breakeven.Managing Equity Growth:

As equity grows, controlling large unrealized profits becomes vital. Watching gains like +$500,000 drop to +$280,000 in a single session can be mentally taxing, especially with 80% portfolio utilization.Balancing Risk:

The system is designed to scale risk relative to portfolio size, reducing emotional strain and smoothing the month-over-month (MoM) equity curve.

When to Sell by William O’Neil

1. Largest daily price run-up

a. Sell if an extended stock has its biggest gain since the move started.

b. Being “extended” means it’s far above the buy point from a solid base.

c. This usually occurs very close to a (temporary) top.

2. Heaviest daily volume

a. Sell on the heaviest volume day if the stock is extended.

b. The ultimate top often happens on the highest volume day.

c. Heavy volume means lots of institutional money is getting out.

3. Exhaustion gap

a. Sell if an extended stock gaps up.

b. If a stock suddenly jumps or gaps up dramatically, it might mean the run is almost over.

c. This is called an “exhaustion gap,” and it often signals the top of the stock’s move.

4. Climax top

a. Sell if a stock’s advance gets super extended with the biggest weekly price gain.

b. This is called a “climax top.”

c. This shows the stock is moving too fast and might be close to its top.

5. Signs of distribution

a. Sell when there’s a high daily volume with no price movement.

b. Sometimes, the stock moves a lot one week but doesn’t go higher, with lots of trading.

c. This is called “railroad tracks” because the volume chart looks like two parallel lines.

d. It’s a sign of distribution because institutions are starting to sell.

6. Stock splits

a. Sell if a stock runs up 25%, 50%, or even 100% after a stock split.

b. Watch out if a stock’s price is greatly extended and they announce a stock split.

c. Stocks tend to top around excessive stock splits.

7. Consecutive down days

a. Sell if a stock has more down days than up days consistently.

b. You might see four or five down days, then two or three up days.

c. This means more stock is being sold than bought.

8. Upper channel line

a. Sell if a stock goes through its upper channel line after a huge run-up.

b. Channel lines are upward lines that connect the recent lows and highs.

c. A move above their upper channel line often marks the top.

9. 200-day moving average

a. Sell stocks that are 70% to 100% or more above their 200-day moving average.

b. This one is rarely used.

10. Selling on the way down

a. Sell on the way down from the top, IF you didn’t sell while the stock was going up.

b. After the first drop, some stocks bounce back once but won’t get back to the last high.

Thank you for being an essential part of this growing community! I’d love to hear your thoughts on this latest Substack post. Whether it’s best practices, strategies, or the challenges you’re facing as a swing trader, your insights are invaluable.

This space thrives on shared experiences, and your feedback helps us all learn and grow together. Let’s connect—drop a comment or share your perspective. I’m always eager to engage with like-minded traders and hear your unique take.

If you find this content helpful, consider sharing it with others who might benefit. Together, we can build a stronger, smarter trading community. Thank you for your continued support and collaboration!